User guide

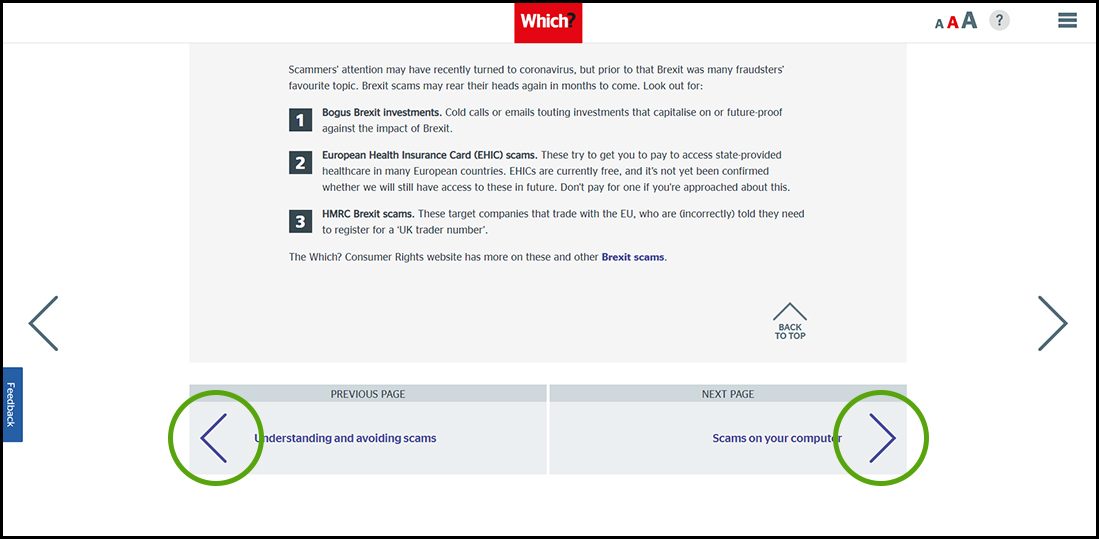

Finding your way around the guide

To navigate between pages, click or tap the arrows to go forwards to the next page or backwards to the previous one. The arrows can be found either side of the page and at the bottom, too (circled in green, below).

Menu/table of contents

Click or tap on the three horizontal lines in the top-right of your screen to open the main menu/table of contents. This icon is always visible whether you're using a computer, tablet or smartphone. The menu will open on top of the page you’re on. Click on any section title to visit that section. Click the cross at any time to close the table of contents.

Text size

On a computer, you'll see three different sized letter 'A's in the top-right of your screen. On a smartphone or tablet these are visible when you open the menu (see above). If you’re having trouble reading the guide, click or tap on each of the different 'A's to change the size of the text to suit you.

Pictures

On some images you'll see a blue double-ended arrow icon. Clicking or tapping on this will expand the picture so you can see more detail. Click or tap on the blue cross to close the expanded image.

Where we think a group of images will be most useful to you, we've grouped them together in an image gallery. Simply use the blue left and right arrows to scroll through the carousel of pictures.

Links

If you see a word or phrase that's bold and dark blue, you can click or tap on it to find out more. The relevant website will open in a new tab.

Jargon

If you see a word or phrase underlined, click or tap on the word and small window will pop up with a short explanation. Close this pop-up by clicking or tapping the cross in the corner.

Help

On a computer, you'll see a question mark icon in the top-right of your screen. On a smartphone or tablet this is visible when you open the menu (see above).

Clicking or tapping on the question mark will open this user guide. It opens on top of the page you're on and you can close it any time by clicking or tapping the cross in the top-right corner.

Looking ahead

Nobody wants to think about a time in the future when they won’t be able to make their own decisions, but there are ways to make it more bearable.

Power of attorney

If someone becomes unable to make decisions about their affairs because of old age, illness, mental incapacity or an accident, they’ll need someone to do this for them. However, many people don’t realise that, even in such circumstances, there's no automatic right for a next of kin to step in.

Failure to prepare for this situation can lead to a whole host of complications when it becomes necessary to take care of even fairly simple actions, such as drawing money from a bank account, let alone something more complicated, such as selling shares or a house.

Fortunately, there are relatively straightforward and cheap procedures that help take care of these challenges. Setting up a Power of Attorney Power of AttorneyLegal permission for someone to manage the affairs of another when they are no longer able to means that, should the need arise, someone can make key decisions about someone’s health, living arrangements and finances.

What is a Lasting Power of Attorney?

Power of Attorney enables someone to manage the affairs of another person who is no longer able, or willing, to do so. Since October 2007 this kind of arrangement has been known as a Lasting Power of Attorney (LPA).

By setting up an LPA, you grant a trusted individual (or individuals), known as an attorney(s), the legal authority to look after your affairs. Attorneys have the right and the duty to act in your best interests.

Without an LPA, a relative will usually have to apply to the courts before they can start dealing with the affairs of a loved one who has become incapacitated – and this can become a difficult and expensive process. It’s crucial that you don’t leave it too late. You can only set up an LPA while you have the mental capacity to do so.

There are two kinds of LPA to choose from:

- Property and Financial Affairs LPA: this covers things such as managing day-to-day finances, debts, benefits and buying or selling property. It must be put in place and registered while the donor has mental capacity.

- Health and Welfare LPA: this covers issues such as NHS treatment, care and housing. It needs to be put in place and registered while the donor has mental capacity, but it can only be used after the donor has lost mental capacity.

Enduring Power of Attorney

This type of Power of Attorney existed in England and Wales until 2007. It’s no longer possible to get a new one, but if you or your relative has an old one in place it will still be valid, should you need to register it in future. It’s only applicable to financial affairs and is effective immediately. It does not have to be registered until such time as it’s believed that the donor is losing mental capacity.

There is no one Power of Attorney that is applicable to the entire UK. The information above is for England and Wales. If your relative lives in Northern Ireland or Scotland, visit the Which? Wills website to learn more about your options.

Where there's a will

For most people, what happens to their property and possessions when they die is a matter of great importance. A will can ensure their wishes are taken into account.

We all know we should write a will, but it’s estimated that about one in three people die without having made one. This can mean confusion and financial worry for your family or dependants after you’ve gone, and you can’t be sure that your money and property will be passed on according to your wishes.

Which? provides an affordable, easy-to-use online will writing and Power of Attorney service which can help you get your afairs in order. To get started with choosing the right options for you, try our free Wills and Power of Attorney selector tools.

What about inheritance tax?

If your estate is worth more than £325,000 when you die, your heirs will usually have to pay (IHT) of 40% on everything over that amount. The exception to the rule is where an estate is inherited by a spouse or civil partner – then there is normally no IHT to pay. What’s more, the £325,000 IHT allowance (known as the ‘nil-rate band’) can be passed on to a surviving spouse or civil partner, meaning that, when they die, they can leave an estate worth up to £650,000 free from IHT.

There is a further £125,000 IHT allowance to cover the value of a main home. This is set to rise to £175,000 per person by 2020. By then, a couple will potentially be able to leave behind an estate worth up to £1m tax-free.

Even where an estate is likely to exceed the IHT threshold, there are things you can do to help reduce the bill:

- Spend your money while you’re alive, or give it away.

- Make full use of any tax-free gifts you can make while you’re alive. Generally, as long as a gift is made to an individual more than seven years before your death, it won’t count for IHT.

- Insure against IHT by taking out a whole-of-life policy, written in trust. The money paid out when you die goes directly to a named beneficiary rather than into your estate.

Check out our in-depth article on inheritance tax for more detailed information and advice.