User guide

Finding your way around the guide

To navigate between pages, click or tap the arrows to go forwards to the next page or backwards to the previous one. The arrows can be found either side of the page and at the bottom, too (circled in green, below).

Menu/table of contents

Click or tap on the three horizontal lines in the top-right of your screen to open the main menu/table of contents. This icon is always visible whether you're using a computer, tablet or smartphone. The menu will open on top of the page you’re on. Click on any section title to visit that section. Click the cross at any time to close the table of contents.

Text size

On a computer, you'll see three different sized letter 'A's in the top-right of your screen. On a smartphone or tablet these are visible when you open the menu (see above). If you’re having trouble reading the guide, click or tap on each of the different 'A's to change the size of the text to suit you.

Pictures

On some images you'll see a blue double-ended arrow icon. Clicking or tapping on this will expand the picture so you can see more detail. Click or tap on the blue cross to close the expanded image.

Where we think a group of images will be most useful to you, we've grouped them together in an image gallery. Simply use the blue left and right arrows to scroll through the carousel of pictures.

Links

If you see a word or phrase that's bold and dark blue, you can click or tap on it to find out more. The relevant website will open in a new tab.

Jargon

If you see a word or phrase underlined, click or tap on the word and small window will pop up with a short explanation. Close this pop-up by clicking or tapping the cross in the corner.

Help

On a computer, you'll see a question mark icon in the top-right of your screen. On a smartphone or tablet this is visible when you open the menu (see above).

Clicking or tapping on the question mark will open this user guide. It opens on top of the page you're on and you can close it any time by clicking or tapping the cross in the top-right corner.

Five steps to successful pension planning

Keep a close eye on how much you’re saving so that you’ve got time to adjust your plans in order to hit your targets.

Are you saving enough for retirement? The secret to securing a good pension income is planning ahead, with regular monitoring of your progress to ensure you’re on track. Use our five-step process to do exactly that.

1. Work out how much is enough

The common perception is that you will need between half and two thirds of your final salaried income levels as a household, after tax, to maintain your lifestyle. You’re unlikely to need your full final income if you’ve paid off the mortgage, are no longer bringing up a family and don’t have commuting costs.

2. Work out what you'll spend your money on

To make sure the general rule fits your own circumstances, think about what you'll spend your money on later in life. For example, travel and holidays will feature high on the list of priorities for many older people, particularly in the early years of retirement.

As people get older, they tend to spend proportionately less money on food and drink, housing payments and recreation, but there will often be increased spending on utility bills, health and insurance premiums.

3. Think about how much income you'll need before tax

Based on the first two steps, you can set a target income. In doing so, remember that you'll qualify for state pension benefits on top of your private savings, but also that you'll have to pay tax. You'll therefore need to do some sums.

To give you an idea, we did some research in 2018. A couple aiming for a comfortable post-tax income of £26,000 a year would need to generate around £13,475 of that money before tax for themselves, assuming they both qualify for the full state pension in 2018-19 and use their personal income tax allowances. For a couple aiming for a more luxurious lifestyle with £39,000 after tax, the target would be around £29,725.

4. Calculate what size pension pot you will need

If you have defined benefit pension plans, your provider will give you a forecast of what you’ll receive in retirement, which you can use as part of the planning process. But, increasingly, most people will be depending wholly or in part on defined contribution pensions, where you build up a pension pot that can be turned into income on retirement, via an annuity or income drawdown - see How to exploit pension freedom.

You should therefore work out how big a pot you’ll need for your target income. The answers are surprisingly large. According to our workings, even taking state pension into account, a couple looking for £26,000 a year would need a total pension pot of around £206,000 if opting for income drawdown (assuming they invest cautiously, allow for 2% inflation and plan for it to last for 20 years). To achieve the same income via an annuity, they would need a pot of around £268,000. Annual income of £39,000 after tax would require a drawdown pot of about £456,000, or up to £620,000 via an annuity purchase, in some cases.

5. Work out how much you will need to save

With these targets in place, you can work backwards to calculate how much you should be saving each month – based on what you’ve put away already and how long you have to go before retirement.

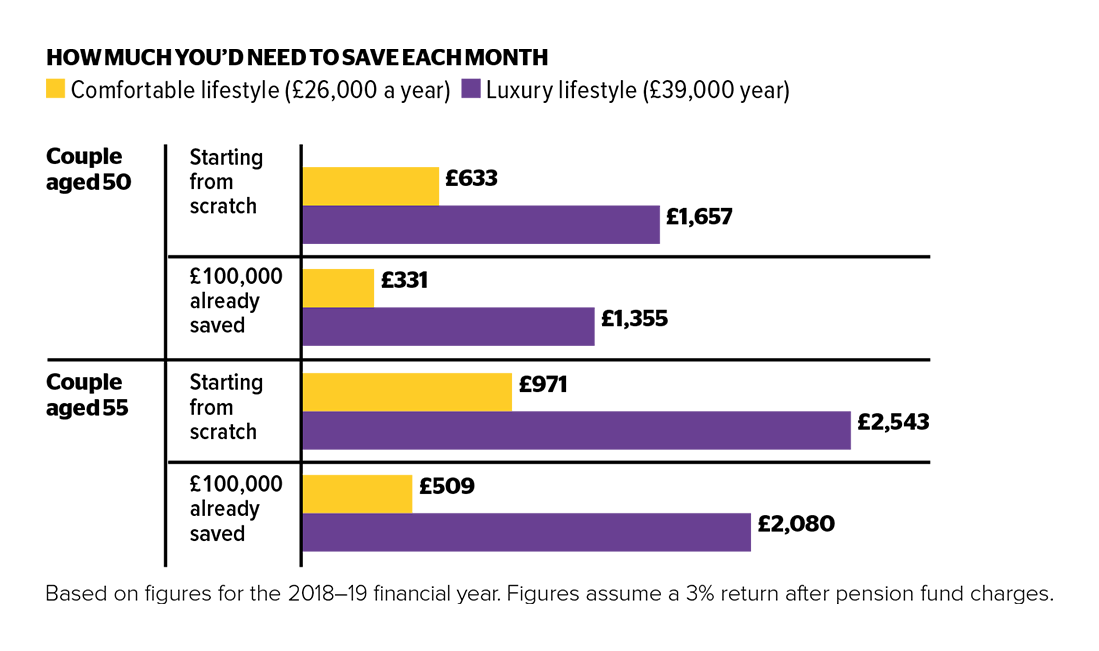

The graph above illustrates what two couples – one starting from scratch, the other with £100,000 already saved – would need to save monthly from the ages of 50 and 55 to achieve the pension pots described in this section.

The amount you need to save to reach your pension goal will depend on how much you’ve already saved and whether you’ve ever paid into some form of final-salary scheme. The Which? online pension calculator can help you crunch the numbers.

1. State pensions – get a state pension forecast so you can see what it will contribute to your plans.

2. Life expectancy – think about your whole retirement; the average 65-year-old today can look forward to around 20 years of retirement.

3. Income security – annuities are more expensive, but if you want to be sure your money will last, they provide certainty and security. For all its potential benefits, income drawdown does involve an element of risk.

4. Inflation – don't forget, you'll need your retirement income to increase over time to counter the effects of inflation.

5. Inheritance – for many people, what they'll be able to leave to heirs is an important part of pension planning. Income drawdown has advantages here.