User guide

Finding your way around the guide

To navigate between pages, click or tap the arrows to go forwards to the next page or backwards to the previous one. The arrows can be found either side of the page and at the bottom, too (circled in green, below).

Menu/table of contents

Click or tap on the three horizontal lines in the top-right of your screen to open the main menu/table of contents. This icon is always visible whether you're using a computer, tablet or smartphone. The menu will open on top of the page you’re on. Click on any section title to visit that section. Click the cross at any time to close the table of contents.

Text size

On a computer, you'll see three different sized letter 'A's in the top-right of your screen. On a smartphone or tablet these are visible when you open the menu (see above). If you’re having trouble reading the guide, click or tap on each of the different 'A's to change the size of the text to suit you.

Pictures

On some images you'll see a blue double-ended arrow icon. Clicking or tapping on this will expand the picture so you can see more detail. Click or tap on the blue cross to close the expanded image.

Where we think a group of images will be most useful to you, we've grouped them together in an image gallery. Simply use the blue left and right arrows to scroll through the carousel of pictures.

Links

If you see a word or phrase that's bold and dark blue, you can click or tap on it to find out more. The relevant website will open in a new tab.

Jargon

If you see a word or phrase underlined, click or tap on the word and small window will pop up with a short explanation. Close this pop-up by clicking or tapping the cross in the corner.

Help

On a computer, you'll see a question mark icon in the top-right of your screen. On a smartphone or tablet this is visible when you open the menu (see above).

Clicking or tapping on the question mark will open this user guide. It opens on top of the page you're on and you can close it any time by clicking or tapping the cross in the top-right corner.

Your tax in retirement

Sadly, your liability to tax doesn’t come to an end once you retire. You’ll still need to pay tax if your income is high enough.

Q: Do I pay tax on my state pension?

A: State pensions are potentially liable for tax, just like any other income you have coming in. The money you receive is paid without any tax being deducted, but if your total income from all sources, including the state pension, is greater than your tax-free allowance (£12,500 in 2019-20), tax is due on your state pension. This will normally be deducted from any private pension or earnings you might have which are paid through the pay-as-you-earn (PAYE) system. If you have no PAYE income, you'll have to complete a tax return, and pay any tax due directly to HM Revenue & Customs (HMRC).

Q: What do I pay on private pensions?

A: Income you receive from private pensions – either from a workplace scheme or from annuities bought with your pension funds – is taxed at source via PAYE. Your tax office sends your pension providers your tax code so they know how much to deduct, but make sure you receive a copy of the code for each source of income so you can check your tax. If you have queries, contact HMRC.

Q: What if I’ve opted to take a lump sum?

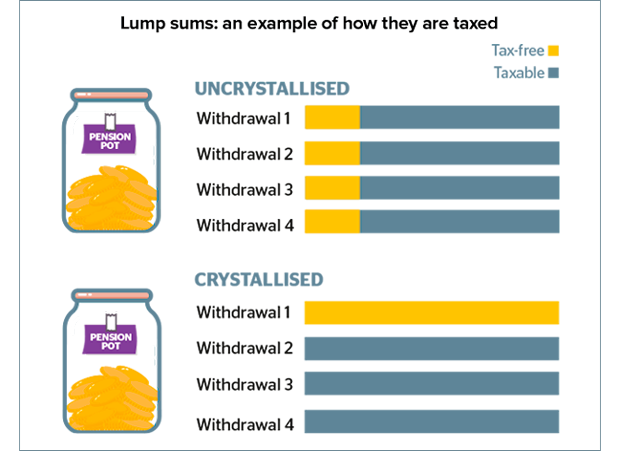

A: The rules allow you to take up to 25% of your pension savings as a tax-free lump sum. You can take more than this amount – even your whole fund – but you’ll pay income tax at your marginal rate on anything above 25%. If you’ve opted for uncrystallised funds pension lump sums, Uncrystallised funds pension lump sumsLump sums withdrawn from pensions outside of income drawdown – the first 25% of this money is tax-free. You can take this money in a single lump sum or in a series of payments. leaving your savings invested and taking ad-hoc lump sums from time to time, you’ll get 25% of each withdrawal tax-free, with tax to pay on the rest (see the graph below). For more on taking lump sums, see How to exploit pension freedom in this guide.

Our online calculator can help you work out your potential tax bills on lump-sum withdrawals.

Q: What tax will I pay in income drawdown?

A: When you take regular income from your pension the fund becomes ‘crystallised’. The first 25% lump sum you take is tax-free. Any subsequent withdrawals you make in income drawdown are subject to income tax:

- if you have no income from any other sources, the first £12,500 (in the 2019-20 financial year) is tax-free

- you then pay tax at 20% on the next £37,500 above this amount

- you then pay tax at 40% on everything above £50,000 (£12,500 plus £37,500)

- you then pay tax at 45% on everything above £150,000.

If you plan to retire abroad, you'll need to understand the tax bands in your chosen country. Your tax liability is normally to your country of residence, even when the income originates in the UK. Learn more about paying tax when you retire abroad.

Q: What tax will my heirs pay on pension savings I leave to them?

A: Broadly speaking, if you die before age 75, you can pass on annuity income (with some types of annuity), income drawdown benefits or a pension savings pot to your heirs tax-free. If you die after age 75, your heirs will generally pay tax at their marginal rate on whatever they receive.

If you’re planning ahead, making a will is one of the best ways to ensure that your wishes are clearly stated. Which? can help you take care of your will.